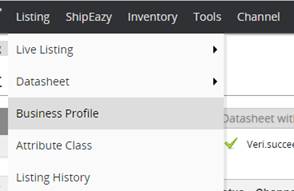

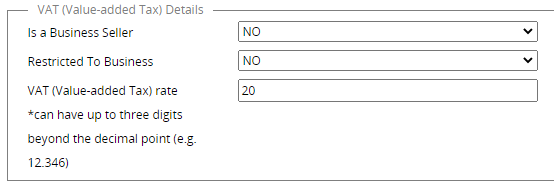

VAT settings in Business Profile

| 1. What is VAT and how is it important to you |

|

Value-Added Tax (VAT) is a tax on services, including services provided by eBay. You should consult an independent tax advisor and/or a local tax authority to determine what laws and rules apply to you, including whether you should register for a VAT ID with eBay and whether, and how much, VAT must be charged on items you sell. VAT-enabled sites: Ireland, India, Switzerland, Spain, Holland, Belgium, Italy, Germany, France, Austria, or the United Kingdom. The VAT rate varies depending on where you reside (or have a permanent address or establishment). You, or the sellers who use your application, should ensure that the registration address you provide to eBay is correct, especially the country designation. eBay sellers may add his/her registered VAT numbers in different countries/regions in the following pages: https://www.ebay.com/spr/vat |

***Fin***